December 2025 Newsletter

Santa needs a new ho ho home!

‘Twas the night before Christmas, and at the open house;

Not a creature was stirring, not even a mouse;

The for sale sign was hung in the yard with care;

In hopes that a buyer would soon be there;

The sellers were wringing their hands with fright;

They said “Oh why didn’t we list with Mike.

”Then upon their ears they did hear;

Was that the sound of Santa’s reindeer?

No it was not, not who they’d expect;

It was Mike Juliff, Realtor in his WRX.

Up the driveway he sped with a flash;

He jumped out and said “I’ll list your home and it will sell for lots of cash.”

“Oh thank you, thank you so much” said the sellers;

“We should not have trusted that other feller.”

“I understand” said Mike, with a wave of his hand;

“But next time call me first for homes, investment and land.”

The sellers signed a contract with Mike right away;

Mike said “I can’t wait to help you, but sheesh, its Christmas eve today.”

He jumped back into his sleek blue sleigh;

Fired up the engine and peeled out the driveway.

And I heard him exclaim, ere he drove out of sight –

“Happy Christmas to all, and to all a good night!”

Twin Cities Real Estate Market Update:

December 2025 Issue

Even Santa is starting to consider moving in the New Year. He’s only been in the North Pole for ages and his place needs quite a bit of updating. Though he’s got a super low interest rate, he is liking the way rates are trending (and you probably are too!)

Real Estate Meme of the Month

How many of you can sang it in your head? (I know I did…)

The Market

The Fed delivered an early Christmas gift earlier this month, cutting overnight borrowing rates by another quarter point. They also signaled plans to begin quantitative easing stock purchases — which historically tend to give the stock market a little holiday cheer and help consumer interest rates loosen up. All told, it’s been a surprisingly strong end to the year when it comes to home affordability… no fruitcake required.

While this is typically a slower time in the real estate market — and many folks are busy warming their feet by the fire or untangling Christmas lights — it’s actually been a great opportunity for ambitious home buyers. Those willing to shop while others are focused on holiday parties are getting the trifecta:Very little competition (no bidding wars and typically getting seller to pay partial closing costs)Lowest interest rates in 3 years (more affordable payments)Lowest price point for homes of the entire year (peak in summer)

Looking ahead, most experts predict 2026 will bring continued moderate home value growth of around 2–4% locally in the Twin Cities market. Mortgage rates aren’t expected to drop down the chimney overnight, but they are projected to continue trending lower into the 5% range. With Twin Cities homebuilders producing only about 6,000 homes over the past year, supply remains tight and the market appears very stable — no signs of a Grinch-like crash or loss of value in existing homes.

If you’ve been waiting to make a move, 2026 could be your best opportunity in the past four years. And if a move is on your wish list, let’s chat sooner rather than later — so you’re prepared and not competing with everyone who waits until spring and suddenly decides it’s time to house hunt… right after the snow melts.Wishing you a Merry Christmas and Happy New Year!

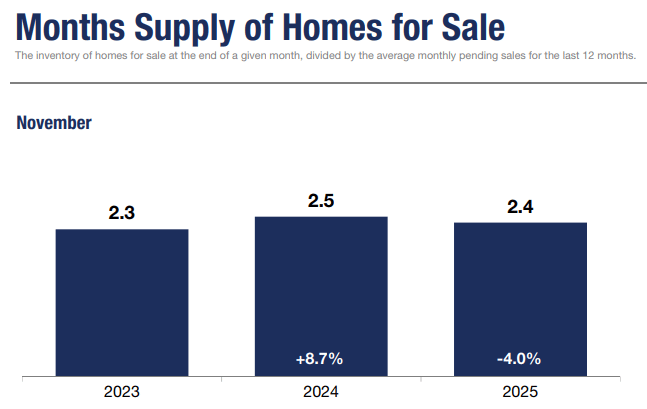

Stats on Stats on Stats: November 2025

(The following data is provided by the Minneapolis Area Association of Realtors for the 16-county Twin Cities region)

Rate Quotes

If you are trying to figure out what current interest rates are like for a mortgage, the following is a national average as of 12/18/2025:

Tour of the Month

This month I helped an owner list their restaurant building for sale in the Morris Park neighborhood of Minneapolis, just southeast of Lake Nokomis and just north of Hwy 62 and the MSP airport. Its an incredible opportunity for someone looking to expand to another location or start their first business venture in the food industry.

The space can accommodate multiple different styles of service and comes with all of the kitchen and dining equipment you need to run a full service kitchen! The list price is $669,900 and the building has 1800 sf of finished space, 600 sf of which are the kitchen and 1000 sf of which are for dining. In addition there is a 10 stall paved parking lot in the back of the building.

Check out the video and let me know if you or someone you know are interested in taking a look!

Restaurant Building For Sale – Minneapolis

For more tours and real estate tips, you can follow me!

Instagram @MpowerAgent

Facebook @MpowerAgent

YouTube @MpowerAgent

Focus on Big-Ticket Systems, Not Cosmetic Issues

During an inspection, prioritize the items that are expensive or affect safety:

– Roof age and condition

– Furnace, AC, and water heater

– Foundation, structure, and drainage

– Electrical panel and wiring

– Plumbing supply and sewer line

Paint, trim, and minor wear are easy fixes — a failing roof or sewer line is not.

Use the Inspection to Negotiate Strategically

An inspection isn’t about asking the seller to fix everything — it’s about leverage.

– Ask for repairs on safety or code items

– Request credits for older systems nearing end-of-life

– Use findings to justify price reductions or rate buy-down

Well-targeted requests are far more likely to be accepted.

Don’t Skip Specialized Inspections When Needed

A general inspection is a starting point, not the finish line.

Consider add-ons like:

– Sewer scope (especially for older homes)

– Radon testingChimney inspection

– Roof inspection by a roofer

– Structural engineer review if red flags appear

Spending a few hundred dollars up front can save thousands later.

How to buy and sell simultaneously:

The tricky part about buying your next home and selling your current home comes down to the financing. Most people can’t qualify for two home mortgages at the same time (but sometimes that works). Everyone’s situation is a little different, but here are the 5 most common ways to buy/sell simultaneously.

1. Qualify for both mortgages

A. Buy your next home using an offer that is not contingent on your current home selling

B. Move into your new home

C. List and sell your previous home

D. Additional one time downpayment on new home if desired

2. Buy contingent on sale of your current home

A. Write an offer on your next home that is contingent on you selling your current home (hard to compete in multiple offers)

B. Add in a longer closing timeframe to give you time to market your home

C. List your current home for sale

D. Close on both homes the same day

3. Sell contingent on buying your next home

A. Find a buyer for your home

B. Negotiate a longer closing timeframe and potentially a rent back where you rent the home from your buyers (60 day max)

C. Shop for and write a contingent offer on your next home

D. Close on both homes the same day

4. Use a bridge loan

A. Need significant equity to get approved for this product

B. Lender writes a short term loan with interest only payments

C. Buy your next home using an offer that is non-contingent on your current home selling

D. Move into your new home

E. List and sell your previous home

F. Pay any fees required for the bridge loan

5. Sell and then rent temporarily

A. List your current home for sale

B. Sell your home

C. Move in with friends, family or a short term rental/hotel

D. Store your belongings somewhere temporarily (recommend a Pod or similar service so you don’t have to move twice)

E. Shop for and buy your next home

Schedule a meeting with Mike!

https://homesforsalemaplegrove.com/contact-mike-juliff-for-maple-grove-real-estate-for-sale/

Upcoming Events

Pause for the Holidays: Buyer & Seller Seminars – Coming January 2026, stay tuned!